What is Core Banking?

At a time when the focus of most Bank’s strategy and investments is on “Digital Transformation” sight is often lost on the importance of a modern, flexible and scalable Core Banking system. After all, Core Banking is the heart and lungs of any Retail/Business Bank.

When Digital Transformation starts to hit hurdles and returns on investment fail to meet expectations part of the blame is typically attributed to legacy systems, first and foremost of these being Core Banking.

However, all too often there is confusion amongst stakeholders of what exactly comprises Core Banking, what purpose does it serve and why it is the single most important system of any Retail/Business Bank impacting on the performance of all lines of business.

It should be self-evident but a starting point is needed as there are as many variations on this question as there are Core Banking systems.

What comprises Core Banking?

Institution Profile:

Information about the Bank including central clearing houses, central banks, regulators, other banks, payment processors, branch details, etc.

Operational Information including cut off times, bank holidays, contact information, Nostro/Vostro accounts etc., 24*7 operational rules, end of business day, start of business days, User profiles and access rights, authorisations, delegations etc

Products, Transactions and Services Information:

Product Definitions, interest calculation methods, accrual methods, min/max balances, GL postings etc

Overdraft facilities, Credit Line facilities, Letters of Credit, Bank Guarantees, Fees & Charges, Commissions, Penalties, Limits/Exposures, FX, Guarantees, Payments handling incoming/outgoing etc.

Customer Information:

A subset of CRM , basic information to “know your customer”, identify, manage bank accounts, calculate interest, charges, fees and taxes on their accounts, process financial transactions, reporting etc

Deposits, Savings and Investments, Secured and Unsecured Lending, Credit Facilities etc.

Creation, maintenance and operations of customer accounts as per Product, Transactions and Services rules.

Processing of financial, maintenance and enquiry transactions. Calculate and capitalise interest, calculate and apply fees, charges, penalties, Stops, holds, restrictions, mandates, sweeps (push & pull), payment initiation ad hoc, periodical, event driven etc

Reporting

Operational, Statistical, Management and Regulatory Reporting. Ad hoc, user defined reporting queries etc.

The above is not definitive, in fact it is only the very tip of the iceberg. So when Core Banking Transformation is first broached it is key to understand what is meant by Core Banking. It’s scope, it’s importance and its purpose.

What purpose does a Core Banking System serve, why is it so important?

Core Banking at its heart is the ledger of Customers Assets and Liabilities held with the Bank.

It’s a system of record. The final arbitrator of a customers account balance, interest accrued, financial transaction history, guarantees, collateral etc.

It’s the Banks customer account financial transaction processing engine. It interfaces with Mobile Banking Apps, Internet Banking, Branches, ATM’s, Chatbots, Payment Processors etc and its where the heavy lifting is performed. When I worked on a bid for one of the largest Chinese Banks, with over 280 million customer accounts, we had to prove our Core Banking system could handle over 4,500 banking transactions per second. Most Banks won’t be that big but the point is, the better the performance the less your need to spend on kit on the floor and/or resources in the Cloud. I told that story to a CIO of one of Australia’s Big Four Banks, “we’ll never be that big” was their response as they went out to buy more kit to run their selected core banking system than the Chinese Bank ended up buying with over 25 times the number of customer accounts. Some decisions may lead to a successful implementation but at what cost?

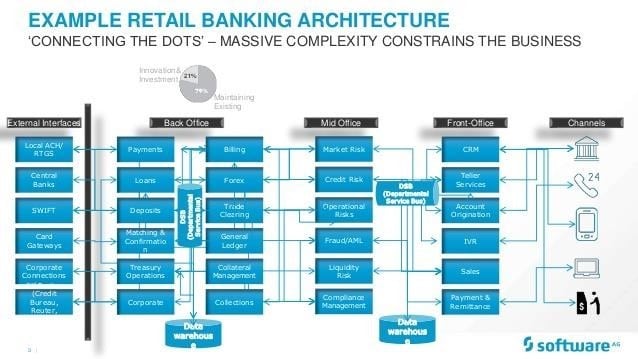

As figure 2 shows, Core Banking sits squarely in the Back Office of a Retail Bank and is connected to external systems, middle and back office and channels. Not surprising that any failure of the Core Banking system has the potential to impact upon the entire Consumer and Business Banks operations and significantly disrupt services to customers.

In reality a failure of the Core results in the whole of the Retail/Consumer and Business Banks being put out of action. There’s no access to Customer Accounts, payments cannot be processed in real-time, ATM’s may work off stored balance files but these soon get out of step, Mobile Banking Apps are left high and dry, Branches might be able to process paper based transactions up to certain limits, outward payment files (e.g. standing orders cannot be generated) and inward payment files cannot be processed, bills don’t get paid, salaries and pensions don’t get posted into customer accounts, mortgages don’t get paid. Customers lose their trust in the bank, the regulators get on the Bank’s back, shareholders get nervous as shareholder value suffers. You get the picture.

So you’re still convinced you need a Core Banking Transformation, why?

Many organisations find that after spending tens if not hundreds of millions of dollars on digital transformation they hit a brick wall. Launching mobile banking apps, chatbots, internet banking applications, tap and go NFC enabled cards, virtual cards and wallets, enabling Apple Pay, Samsung Pay and so on is not enough if the Core Banking engine is not able to run 24 by 7, process transactions real time, cannot speedily launch new products and services to market and cannot scale to handle increased loads. Legacy Core Banking inhibits compliance with Consumer Data Rights aka Open Banking and the opportunity to take advantage of same. Legacy Core Banking, typically not able to handle real time payments, creates complexity, cost and inhibits support for faster payments, i.e. New Payments Platform. Legacy Core Banking prevents timely, flexible and efficient launches of new customer experiences critical to fending of the challenges of big-techs and fin-techs.

Furthermore, if Banks are to offer new, innovative and better customer experiences to keep ahead of traditional competitors and challenger banks then they must move away from traditional product centric siloed banking models. The Core Banking system has to be nimble and flexible enough to support any Transformation initiative.

At the risk of stating the obvious Transformation starts with the Business, there is little point in migrating to a new Core Banking system if it is to only to do the same old thing, just a little bit better.

As some Banks in Australia have found recently when they have gone ahead with a transformation based on unclear objectives, a weak Business Case, unsubstantiated costs and benefits and an ill-defined end state all compounded by a decision to go with a “digitally enabled” legacy system from long established vendors of legacy technology, it is no surprise it all goes badly wrong.

By “digitally enabled” legacy system I mean Core Banking systems that have been around for several decades and may have been given a nice new veneer using SOA adaptors and more recently API’s but it’s pretty much the same old legacy architecture, design and code underneath. Even more concerning is that these vendors remain stuck in legacy thinking mode, they are driven by “run rates, maintaining maintenance income, keep customers hostage and thereby increasing technical debt and although driven by the need for sales their marketing talk up innovation, microservices, blockchain etc these are usually no more than empty promises. Not forgetting that old world vendors will always struggle with a commercial model aligned to business performance measures of cost, revenue and customer experience.

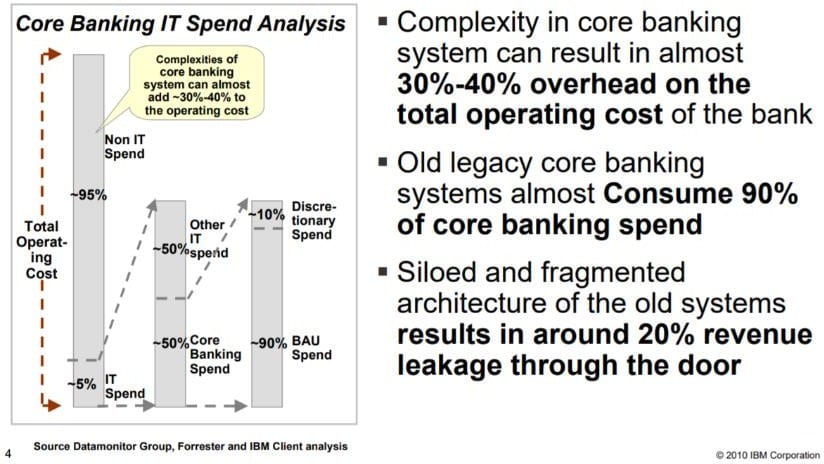

Identifying expected cost savings doesn’t need to be that difficult, as figure 3 shows, there are considerable savings in retiring legacy systems.

However, the key is “retiring”. As many Banks have found, if the Executive Sponsor doesn’t push the transformation all the way through to it’s logical end and do not replace all legacy systems then the expected savings are eroded.

In some cases costs will significantly increase because the Bank is now running their new system and their legacy.

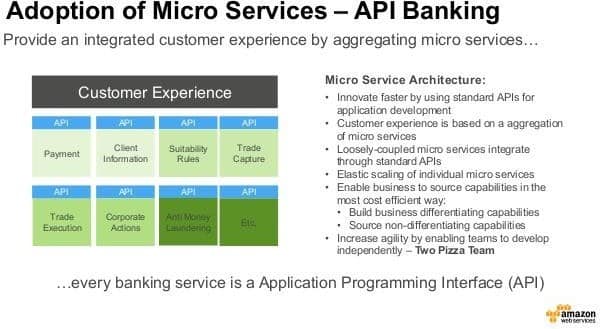

Amazon Web Services have a view of what well designed customer experience applications should look like in the “cloud”. Whilst, arguably, they don’t understand Core Banking nor have any real experience of it the adoption of API’s and Microservices does allow for a less-risk approach to Core Banking Transformation. Whilst this article does not discuss implementation methodology or solution design we do recognise that the rip and replace approach is not practical and there are better ways such as “book-end”, “hollow-out” and so on.

Having made a decision that the current Core Banking system must be replaced many Banks go on to make their next big mistake. The Procurement led Selection Process predicated on RFI’s, the size and complexity of RFP’s in the past, and RFP’s that put “War and Peace” to shame for their scope and size and the time taken by Vendor’s and Customers alike to process and to reach a decision can extend out to months and in some cases years.

The world is changing quickly, driving continual changes in the wants and needs of the business to compete in a rapidly changing competitive environment that is exasperated by ever changing customer expectations and compounded by the constant flow of innovative use of technology. The only certainty is the the criteria defined at the state of a traditional procurement process is out of date almost before the ink has dried on the RFI/P.

History is littered with instances where the more complex and time consuming the selection process became the worse were the outcomes. What gets lost in all of the complexity of functional and non- functional requirements, the length of time taken and the selection by committee approach is a single laser focussed vision of what the Bank wants and where it needs to be.

Does it come down to one key stakeholder who understands the vision, to hold it all together, to drive through difficult changes, to keep the faith and to be the inspiration for the rest of the bank. The simple answer is yes. Perhaps they should be called the Executive Owner not Sponsor.

Making the right decision, executing successfully and reaping the rewards.

If you are the Executive Owner, then you need someone with a cool unemotional head to sit across your Transformation program, unemotional but passionate because Core Banking Transformation is what they do.

Someone with an impartial and independent and questioning mind, who is not emotionally attached to the bank or the vendor so that they will give you the bad as well as the good news, raise the risks and issues that need to be focused on, intermediate where needed and keep everybody focused on the outcomes.

Key to success is working with an an expert group that is independent and impartial, carries no allegiances to technology vendors, that will guide you through the selection process and have the courage of its convictions to work with you to oversee the implementation and to realise the benefits.

Most importantly, an expert group that has Core Banking embedded in their DNA and has earned their stripes in the crucible of multiple Core Banking projects across a number of different Core Banking solutions, vendors and technologies..

Engage that expert group early, before you make your Core Banking decision. One that brings the right skills, experience and commitment to stay with you through strategy, selection, initiation, execution and closure.

Author: Glenn Stafford – Liberty IT Sales Executive