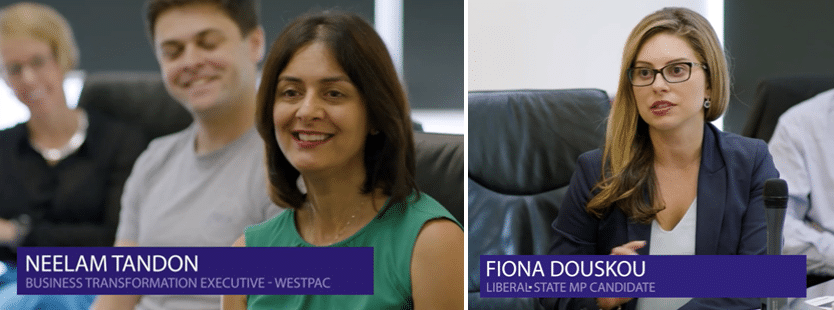

This year we’ve seen a lot of excitement around artificial intelligence, particularly ChatGPT. You can’t avoid it. The way ChatGPT is being integrated into search tools such as Bing and so many other office integrations is really exciting and changing the way we search for information. Interested if you could share your thoughts on artificial intelligence in banking and finance today and what exciting developments are you seeing going forward.

Neelam: AI means different things to different people. And you’re definitely right in the ChatGPT is hogging all the headlines right now. I think the critical thing here is AI is actually a tool. And the important thing to remember is that tools can be used for good and they can be used for bad. So the first thing I focus on, or we focus on as an industry is actually how do we make sure AI is being used ethically. And we’re doing a lot of work with government regulators and with other industries to make sure there are parameters and also controls and very stringent controls to make sure it is being used ethically. And for the ethical purpose we’re considering right now is actually how do we solve our biggest problems like fraud? How do we actually detect it upfront and be proactive and look after our customers? How do we actually use our bots to be more intuitive and save people time? And there’s other industries, of course, who are also exploring opportunities with AI. So it’s actually here and it’s here to stay. In terms of how I see AI moving forward, I don’t see it replacing humans. We’ve seen the case studies recently where actually it’s not super intelligent. We still need humans to work alongside AI. So it will be a tool that will work in our day-to-day jobs and actually will make it more interesting for us. It will reduce the mundane tasks. It will actually make us more efficient and actually ultimately build better connections and relationships and grow businesses. In terms of AI moving forward, I think it’s very exciting. There’s so much exploration going on and can only see us transforming as a country and globally as time goes on.

Fiona: That was great. So Neelam is correct in saying that AI is a tool. It’s there to harness the new gold, data. Being the new gold. Banks are already doing that very well. They’re very mature in harnessing artificial intelligence, the data from artificial intelligence to make predictive and proactive decisions when it comes to providing a customer with loans or a credit and targeted marketing as well. In terms of ChatGPT, ChatGPT can introduce a richer, deeper data source, which can then influence the banking’s decisions on whether to provide a customer with a certain product or not. It also can open up different revenue income streams as well as you tap into richer and deeper sources of data. You understand you get more insights around customers and the way that they’re actually purchasing and perhaps even future purchases. So you can actually become… You get on the front foot as a bank and be more proactive. Some of the benefits of open banking and data is that it that it provides banks and being on the front foot. However, one of some of the challenges is that the quality of the data. Where are you getting your data from? Can you actually trust it to actually make really good and positive decisions? Product investment is very important and that can actually be quite costly for a bank. So that data can then be utilised to provide a really great strategy in terms of where to invest and how to enhance products in real time as well, as we’ve seen. So data is there through AI to better inform banks about their customers, their customer base, how to acquire new customers, how to change products in real time, and also how to personalise the customer experience, which is extremely important in light of open banking as open banking has allowed for the transfer of customers to be quite efficient. So the personalisation is extremely important when it comes to retaining and mitigating churn with customers.

Link to Video: