Liberty IT Consulting Group is an Australian IT company. Liberty services the banking and finance sector and specialises in transformation Project Management. Key areas of focus are core banking, digital, integration, migrations, cloud, project quality assurance, project governance, advisory, and project recovery. Liberty’s business analysts, project managers, directors, PMO professionals, engineers, and agile practitioners are the finest in their field.

Visit us at https://lnkd.in/gZ7FeqkJ for all your technology needs and let us be your solution implementation partner of choice.

Can you open a new bank account with a new bank simply by having your face scanned? Is 100 point check a thing of the past? I have been banking with the same bank for 20 years yet every time I talk to them I need to keep identifying myself. What do they do with all this personal information of mine that they keep? Our expert panel explains.

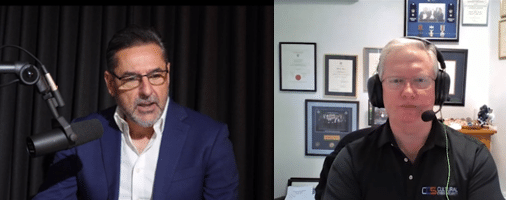

TRINA: Digital identification and biometric recognition what kind of impact will it have on banking? Eric, If you visit a local bank branch. And attempt, any type of enquiry or request customer service or attempt to transact regardless of the fact. You might be an existing client, you need to identify yourself using your driver’s license or something similar. If you apply for a new product and you’re a new client, you probably need to do a hundred point check. We’re seeing MasterCard leading the way in biometric recognition and digital identification. These are some examples of what the future holds. What should we expect to see in the future of banking solutions?

ERIC: So… when, when I fly back to the US tomorrow, I’m going to walk through immigration, to a machine, I’m gonna look at it, it’s going to print me a sheet of paper, I’m going to walk out. That’s it, right? So, if I can get into my country with a machine, I should be able to walk into a bank and be recognized on that same instance.

I spent about 10 years in the automotive industry and we had this theory … it’s BMW. We had this theory, when somebody pulls into a store for servicing or whatever that we should have enough technology within the car and within that store to know who I was when I walked out of that … that car. “Mr. Purdum, thank you for bringing your BMW in. What do you need help with today?” Or “thank you for bringing your BMW in, the car’s already called us. We know what you’re here to do, right?” I think banks need to do better at this, right? I think they need to understand the customer better and not just my digital footprint, but what is it I’m doing online. So, I’ve got a bit of a different take on this, right?

So, when my son was born, seven years ago, you know, I was on Amazon, used to buy movies, play video games, whatever, I ordered diapers and wipes the first time and about 30 seconds later, Amazon sent me an email saying “we’ll deliver those to your door, every 30 days, here’s a 15% discount.” I just could not click fast enough on that offer, right? My bank had no clue I had a life change going on, right?

So it’s not just the… when I walk into a branch or I’m online. It’s understanding me as a person and the… and the life events that I’m going through. It wouldn’t freak me out if my car wanted to drive me there. So, if I do, I’d like it to drive me to the restaurant too. Like… so,I think there’s a huge opportunity for a digital footprint to be created and I’m choosing to work with my bank so you know if you ask me, is it okay to store my data? Sure! I’m okay with that. So, I think that… that should be a goal for us in the next 10 years; at how do we get better at recognizing, not only my digital presence, my online presence, but also me as a person. What’s going on in my life and how the bank actually impacts me in those… in those positions, I think it’s a big challenge for all of us.

CHRIS: and Trina can I just add it and it is a U.S. example. Uber were held up wanting new drivers. They couldn’t onboard drivers fast enough because the drivers didn’t have a bank account and they had to go then line up in the branch and it was just taking too long. So, Uber added a … basically, an account origination into the onboarding process for a driver and overnight they became the largest acquirer of small medium enterprise accounts in America.

Now, it’s one thing that the banks are just kind of not up to the point where others are, but if, if the… if other companies can’t get banking done fast enough then they’ll find another way.

And so, it’s a threat and it wasn’t that Uber went “we had these Banks, we’re really going to screw them”. They just went, “we’ve got a business model and you’re in our way”. So, I would say everybody’s got to be doing as much with technology as they can and if I’m a bank, I need to be giving my customers the opportunity to do banking because they’re trying to do something else, right?

And that’s… so when they’re searching for a washing machine, the financing is there. But we’re not there yet.

ERIC: and why do I have to fill out a form every time I want to get that financing? everybody knows who I am, right? It’s… I want to get that wash machine here at fill out these 20, these 20 fields, why? It did boggles my mind that …that… that has not been automated yet, too. Especially, if I’m working with my bank on that, right? Buy now, pay later, right? That should be something we should be for … I’m not a big fan of the product myself, to be honest with you, but the … the application of how we do that in daily life, I still (feel) is missing so much little detail. And, how we can just expedite that process going forward. I think it’s a big challenge for us. I also think, you know, banks, you guys have some the most unstructured databases in the world. You have great data; if we could figure out how to harness it, right? And you know, if I look at data warehouses, data lakes now, that exist within Banks, it’s a treasure trove of data that we have no ability to actually use. And I think if we can get to that point where we can… the digital identity and you know all that history about me, think about what we could really do with that. I think it’s… I think it’s just a treasure trove. I really do.

THEO: If I can just add in terms of Eric here… I think, the key thing here is embedded banking, right? It is to have banking at the point of where you want to do something. And, I think one of the key approaches that we’ve taken is to move away from just custom interface or UX design to actually, human centric design. Which we actually step back and actually look at the human as an individual and its life stage journey. What is he actually doing? It comes back to you, I think that’s what Eric was saying… to understand where he is in his life stage. How does he interact and what does he do? And, actually, then appropriately interact with the person as well. I think the other things that we’re also looking at and we’re doing a lot of advanced work in it, is to actually use sentient AI, driving a lot of the interactions either via voice or sort of automated actions as well that actually can understand, let’s call it, EQ, smart AI in the background that actually understands what the person is doing, how he’s feeling, how is he anticipating, right? So, because I think, if we look at digital, as I said, there’s so many things that are… what is a big thing that’s going to change it? Smarter UI, smarter UX, better journeys. I think we exhausted all of those. I think we’re fairly mature where we are in terms of UI / UX design. I think the next thing is… there’s two sites that we looking at … first sentient AI are supporting your … the end user in terms of driving at whatever means it is and I think the other one is also smart assistance for the bank staff as well, because I think what we have seen is the lot of new automation, or automatic robotic, AI automation is actually to get the human out of the process. What we found is that, if you step back in banking years and years ago, why was banking good? Because you could talk to a human, interact like a human. So, what we need to do is to bring in that interaction back into how you deal with your customer but also super empower your staff to actually providing more value added engagements with your customers and I think something… things need to change. Banks got all the technology, they’ve got this thing and it… it’s time to sort of move into the next phase in terms of … sorry… human-centeric design, and new customer interaction.