We’ve seen regulators start to pay more attention to these sorts of emerging business models, but some providers of BaaS face difficulty in its option in these challenging financial markets. Starting with you, Peter. Could you please tell us what’s in this for the customer, the third party, and then the bank? Where has it worked and changed dynamics?

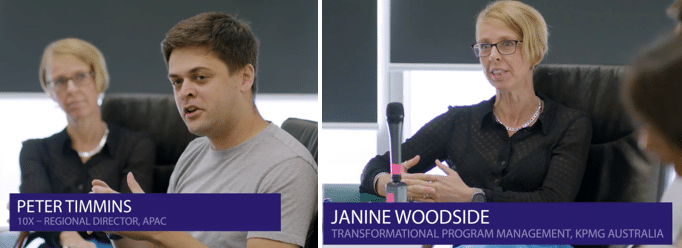

Peter Timmins:

Yeah, absolutely. So, I think one of the first things to do is define banking as a service, because I think across the industry it gets used for a number of sins. That’s why we see some banking as a service providers struggling right now and others actually in a very different position. The way we look at banking as a service is actually a partnership with banks and with those third-party providers, so that we can provide technology, the banks can do what they do best, which is banking, which is regulation, which is managing the change and managing the regulator, and then that third party is able to bring the customer in. That third party is able to provide different customer experiences and different tranches of customer to that bank they might not be able to hold otherwise. So I think that’s how I define banking as a service in the context that we look at it. And what’s in it for each of those parties? Well, banks are able to access those customers, they’re able to differentiate very quickly and use different partners to be able to do that. For the customer themselves, they start to be able to embed that finance within their journeys, because it’s already within the app of whichever different financial institution the bank has worked with. And for institutions like 10X, we’re actually able to scale our presence and work with loads of different banks and loads of different providers around the world to provide differentiated experiences to the customer.

Janine Woodside:

Some good points there, and I sort of think about the three layers of this, and I think we’d all agree that it’s in everybody’s best interests that we have really strong and stable finance system that is well governed, well managed, and well regulated. And I think in a post sort of GFC, post Royal Commission environment locally here in Australia, we are probably one of the most regulated banking industries globally, and that’s a good thing. And I extend that to the level of legislation in terms of design, distribution, obligations, and target market determinations. And this is what the banks do really well. My concern in terms of banking as a service is ensuring that regulation and control across the whole value chain, so right from the customer back into the third party. We do live in an environment where it is, despite the control and regulation and post Royal Commission, it’s still quite popular to bash the banks. And we’ve got a real generation of people coming through that have probably got a stronger affinity and more trust with organisations that are not banks. And I think that’s a real sort of strategic play for banks to be able to access those types of customers. And clearly the benefits are there for the third party as well. From a customer perspective, if I can have a really simple digital experience that is really tailored to my needs, that’s the benefit of banking as a service. Who’s doing this well? I think it’s still very much an emerging and maturing market here in Australia. There’s many players sort of in the pie. The regulators waking up to this. I look to the big end of town and Westpac and the partnership with 10X has probably been a standout. But there’s challenges there as well. So watch this space I think for banking as a service.