Open banking. Since 2020, open banking has meant that as a bank customer, you are able to authorise your bank to share your personal data with other accredited businesses, such as other banks and financial institutions. Can you highlight for us the benefits and obvious risks for a participating consumer?

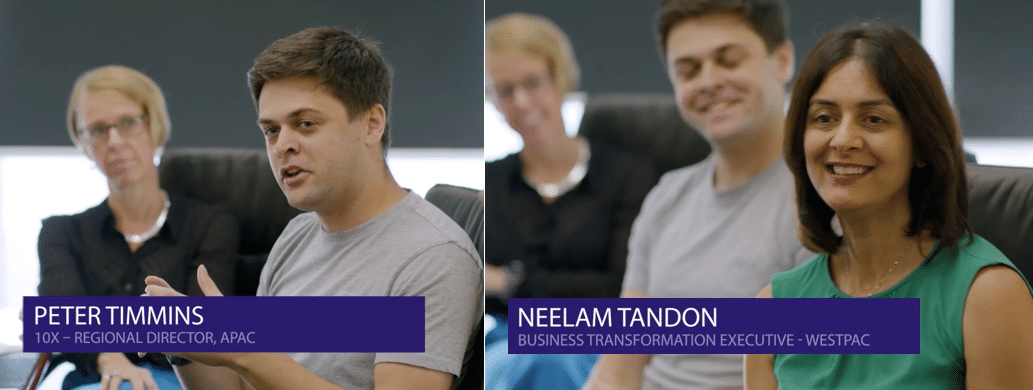

Peter: I think a lot of people are trying to assess open banking and it started in the UK and moved here and it’s still very, very early days. It’s very early days for the banks, it’s very early days for people who want to be involved in that ecosystem and very early days for the consumer and people are still on all three levels of that trying to get their head around what they can do with this technology, what they can do with. What’s the benefits to the consumer and what’s the benefits to the rest of the ecosystem. I think if you’re a retail consumer right now and the ability, most people have two to three bank accounts across two to three different banks and the ability to see all of your information in one place is useful. But I think the UK started this slightly before Australia and people started to use that and then said actually over a period of time did they still want that. So I think there’s a lot to come from open banking. I’m particularly interested in open banking in the corporate space as well, whereas actually, if you look at corporates and they’ve got, particularly multinational corporates, they’ve got many banks across the world, the ability to see that data in real time and see where their balances are becomes super powerful. It becomes powerful for the banks themselves, enabling them to offer different products. It becomes really powerful for the client so they can look at their risk of working capital and the whole organisation, the whole ecosystem then starts to improve because of that. So, I think it really depends on the amount of time we have open banking for and actually what sector you’re looking at it in as well.

Neelam: Open banking, has been around for a while. It’s being developed or being used globally. In Australia, we call it Consumer Data Right? It’s actually open banking. And the important thing here is we’ve introduced it to increase competition. Now, if you imagine a time when you’ve applied for a loan, you’ve been asked by your bank to provide six months transaction data, six months statements, you’ve got to find it, you’ve actually got to post it sometimes, or you’ve actually got to give it to your bank. And that’s when they start validating your application. The beauty of open banking is that you now own your own data. And with the touch of a button, you can share your data with other institutions, which means they’ll start validating your application straight away. So, potentially for consumers is increased competition, so you get the best deal. Secondly, it’s around faster answers and less time spent on your part. The risks that I would suggest that we need to really think about, and it’s been very publicly open, is if there was a data breach. People are concerned around, is my data safe and is it private? And actually as financial institutions, we’re working very hard with all levels of government or regulators and all other industries as well to make sure we keep customers’ data safe and also keep it private. And I only see that continuing even further.

Link to Video: